The new adventures of the beverage category

In the ultra-dynamic world of beverages, innovators are expanding functionality and elevating experiences to keep consumers engaged, with some brilliant results, writes Andrew Wardlaw.

Andrew Wardlaw

16 Jul, 2024 | 5 minutes

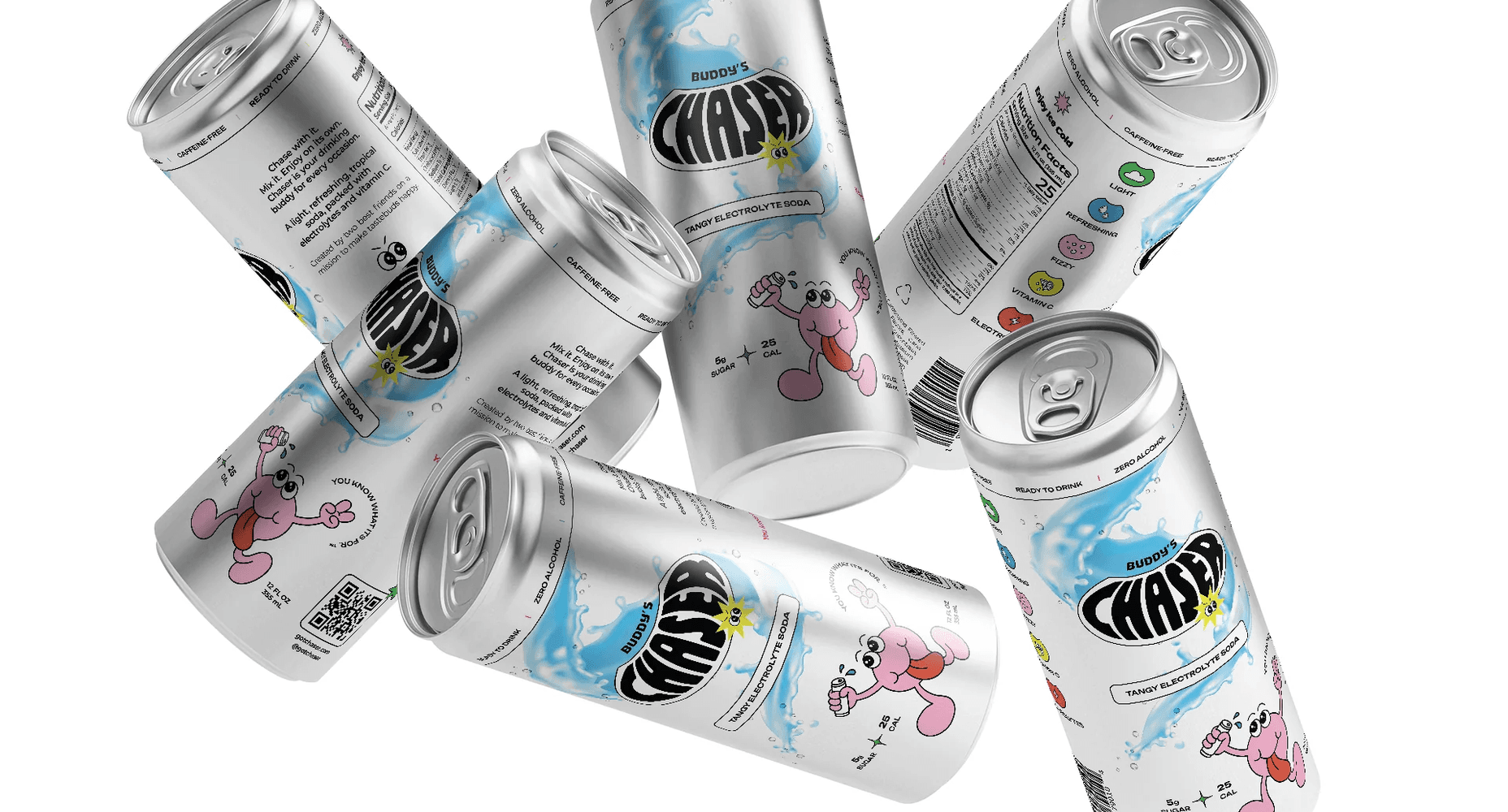

Need something to stay hydrated on a night out? Buddy’s Chaser adds electrolytes to alcohol to keep you hydrated ‘no matter what’.

Craving a soda that totally quenches your thirst? Sprite Chill ingeniously gets colder the more you sip.

Looking for a global adventure? Sake Sling serves Western palates with hitherto unknown tastes from Asia.

Attention grabbing

Cast your eyes over recent beverage innovations, and it becomes clear that manufacturers are pulling out all the stops to capture consumer's attention - fueling the social media hype cycle. But hype can often backfire! First, it can raise people’s expectations, and ultimately lead to disappointment, especially if the product experience is 'unremarkable'. Second, if the hyped product achieves mainstream distribution too quickly, there is a danger that people will perceive it to be a gimmick, and not to be taken too seriously. These dangers could explain the recent rise and fall of PRIME Energy. That said, PRIME has still made a lot of money, boosted category interest, and encouraged established brands to raise their game. Not a bad result!

Glimmer giving

Beyond the quest for people's attention, beverage manufacturers are putting more energy into delivering more memorable product experiences, tuning into rising incidence of a YOLO (you only live once) mindset. This phenomena is a knock on from recent economic crisis and geo-political uncertainty, pushing people into making the most of now. Beverage brands that can generate 'glimmers' - those micro-moments of joy and discovery - are well placed to earn a place in people's repertoires.

Today’s YOLO economy has been credited for saving the world from deep recession as people prioritize the pursuit of pleasure. And as consumer confidence returns, we expect people to be far more discovery led in their choices – forcing innovators to provide a continuous stream of new experiences.

Purposeful brews

A further dynamic supporting modern beverage innovation is people's desire to live more intentionally, manifesting in more goal-directed purchase behavior. Beverage brands that adapt to this new normal stand to gain the most. So, ask how your product ranges can go beyond great taste and refreshment. Poppi sodas already has, ticking boxes related to cravings for nostalgia, as well as support for gut health (with probiotics) and wellness (only 25 calories).

Beverages with benefits meet an increasing human desire to exert a little more control in a world that feels more uncertain.

One intention that cannot be ignored is people’s desire to live more sustainably, and to do this in ways that can be celebrated. More manufacturers are starting to apply the principles of a circular economy: including the elimination of waste & pollution and increasing efforts to regenerate nature as well as adopting more climate-resistant ingredients. And not forgetting the drive towards inclusivity and social justice – both at home and across supply chains.

New adventures

Attention grabbing, glimmer giving and more purposeful! These are some of the key drivers underpinning beverage innovation in 2024, and illustrate how manufacturers are responding to huge changes in the consumer environment. But it is the small and medium sized players that appear to be leading the way...

Across CPG sectors, small and medium-sized manufacturers appear to be stealing a march on multinationals in meeting new demand spaces. According to Circana, SMEs are now responsible for 75% of all new products launched, contributing 68% of total value sales from new products.

With economic indicators beginning to look more encouraging, and global beverages category revenue projected to deliver an annual growth rate (CAGR 2024-2029) of 10.05%, we can expect much more activity ahead, with multinationals looking at ways of democratizing some of the what the smaller players have started.

To support your innovative thinking, we’ve produced a guide that reports on no less than 24 consumer and product trends, and you can get a free copy with one simple click.