Never waste a crisis. What CPG brands should do next.

Amid the current turbulence, the consumer-packaged goods (CPG) sector has reason for concern - but also grounds for confidence. As other industries struggle, CPG stands uniquely positioned not just to endure the uncertainty, but potentially to gain ground, writes Andrew Wardlaw.

Andrew Wardlaw

14 Apr, 2025 | 6 minutes

Resilience is our ‘superpower’

We’ve been here before. The global pandemic and its inflationary aftermath could have derailed CPG, yet sales held firm. “The strength of consumer spending, even after the dark days of the pandemic, has taken me by surprise,” remarked Wendy Edelberg, director at The Hamilton Project – an organisation that monitors the effects of tariff policies on trade. My guess is, Wendy is pretty busy right now.

The resilience of CPG has been proven several times over in recent times. Even during the 2008 recession, U.S. CPG sales declined by just 1.7%, far less than more volatile sectors like auto and discretionary retail. Everyday essentials remain essential - but increasingly, so do small indulgences. Consumers are simply becoming more discerning in their choices. To underline the mood music, a Mondelez spokesperson has already said that the company “remains confident in our ability to navigate the evolving external environment.”

As Ethan Chernofsky of Placer.ai puts it, today’s shopper bucket purchases into two camps: true necessities, and “affordable luxuries”. And CPG brands that understand this nuance are thriving.

Five strategies for uncertain times

To ensure that CPG’s resilience remains, here are some thoughts on where range management and innovation thinking should be right now.

1. Optimize product assortment

In today’s market, where supply chain disruptions and margin pressures persist, tight, data-driven assortment planning is a competitive advantage. Reducing SKU proliferation and minimizing cannibalization can yield big rewards: assortment optimization programs can boost sales and profits by up to 20%, according to NIQ category management research. Brands should double down on high-margin, high-velocity products, while resting underperformers.

Just as important as what stays and goes is how products are positioned on shelf. Aligning with psychological price thresholds - like $4.99 or $9.99 - can improve conversion in times of heightened price sensitivity. Consider developing smaller pack sizes or single-use formats that meet these thresholds while preserving perceived value. Alternatively, invest in bold, relevant claims (e.g. “2x active ingredients,” “clinically tested,” or “saves 20 minutes”) that justify price points and strengthen shopper confidence. This is the moment to fine-tune not only your SKUs, but the full value story behind them.

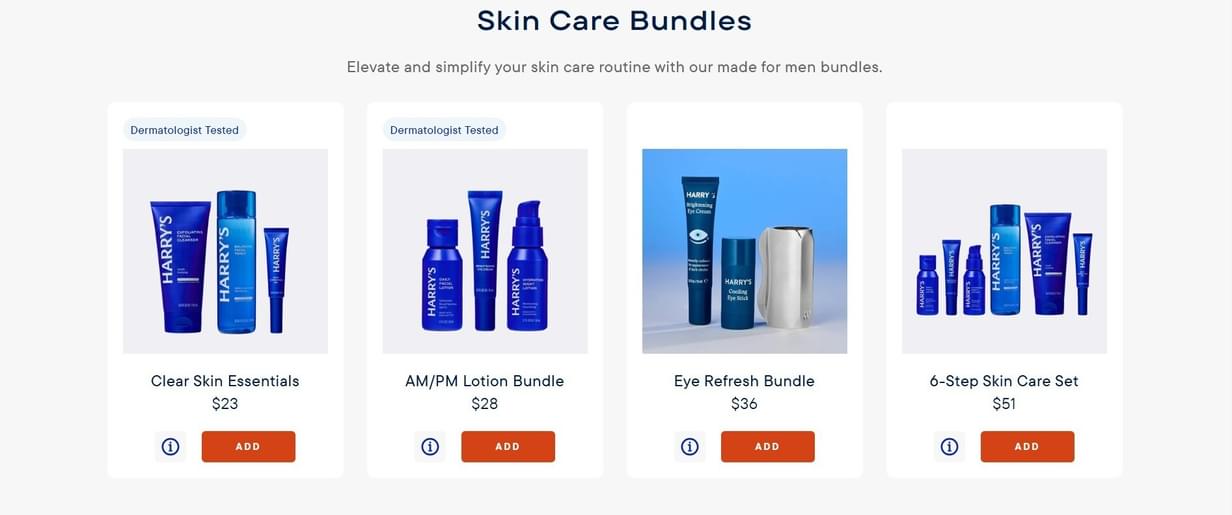

It’s also the perfect time for scenario planning - from format changes that can elevate perceived value, to investigating possible bundling deals that can drive weight of purchase. MMR Data Science & Engineering utilize an extensive and highly cost-effective suite of range optimization and rationalization tools. In recent months, the team has calculated the upsides of introducing a new mini format for a major snack brand – enabling it to compete in the lucrative lunchtime ‘meal deal’ occasion. They’ve also provided the business case for introducing multipacks in a market where sharing formats already have a dominant share. Please get in touch via MMR’s Data Science page.

Bundling has been used very successfully in the QSR sector. Is now the time that CPG catches up?

2. Feed the discovery hype-cycle

In the age of TikTok and algorithmic consumption, novelty sells. Consumers are primed to try new things, especially if they promise multi-sensorial experiences or an element of surprise.

Strategic innovation that’s visually captivating, shareable, and emotionally resonant can drive impulse purchasing, even in a downturn. That’s not about flooding the market with SKUs, but launching thoughtfully: limited editions, purpose-driven collabs, and products that maximise the impulsive dynamic for your category.

Date night discovery. Unexpected collabs and time limited product releases create a highly impulsive dynamic – driving incrementality.

3. Embed joy into innovation

In a world characterized by anxiety, burnout, and information overload, joy is no longer a “nice to have” - it’s a competitive differentiator.

Consumers are looking to brands for uplift: A 2022 global study found that 88% of consumers want new experiences that make them smile, and 78% believe brands should do more to create happiness. When joy is part of a brand experience, consumers are 4.3x more likely to purchase.

Looking ahead, this emotional benefit will evolve into what trend forecasters call Strategic Joy – an evolution from products that offer daily glimmers, to something that is much more central to CPG innovation thinking, offering joyful product experiences that are more intentional, restorative, and culturally relevant. This, I believe, will be key not only to emotional wellness but to long-term brand loyalty.

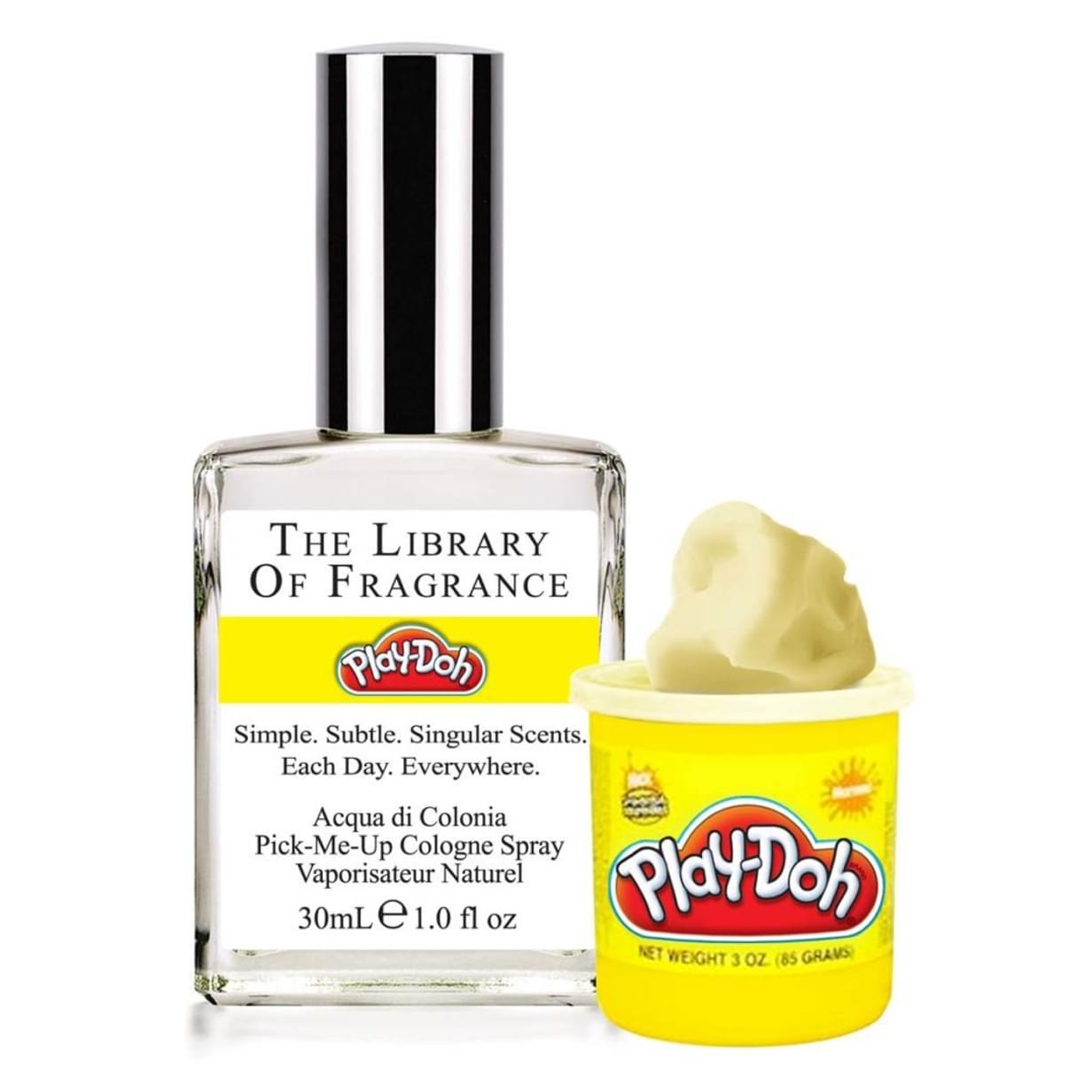

For personal care and beauty brands, this is the time to position joy as a wellness strategy. Products that offer “small moments of happiness” (like sensorial textures, nostalgic aromas or inspirational packaging) are likely to resonate deeply.

Demeter has launched this ‘Pick-Me-Up’ cologne to add playful nostalgia to people’s days.

4. Double down on premium

The idea that consumers abandon premium goods in a downturn is outdated. In fact, the reverse is truer. Many turn toward small luxuries when cutting back on big-ticket expenses - a phenomenon dubbed as the "Lipstick Effect."

During the COVID-19 recession, premium CPG brands grew twice as fast as value brands in certain categories, according to NielsenIQ. Whether it’s a $12 adaptogenic sparkling water or a $30 body oil, these products offer an emotional lift without the guilt.

Retailers are well aware of this dynamic. Target’s “Affordable Joy” program leans into premium-feeling self-care, often sourced from BIPOC- and women-owned brands. Consumers get the luxury experience; retailers get the margin. Everybody wins.

Molson Coors continues to elevate Blue Moon’s positioning through premium packaging updates and strategic innovation.

5. Find opportunities for layered benefits

Today’s shopper isn’t one-dimensional. As Mintel’s Jenny Zegler puts it, consumers “contain multitudes” - and their demands reflect that complexity. They want health and indulgence. Sustainability and convenience. Function and fun. Now is the time to find out what additional benefit your product can offer consumers, without adding too much to overall costs.

Take M&S’s new kefir shot, which promises gut health and brain support through the addition of vitamin B12. It's a product designed not just to meet needs but to upgrade the consumer’s sense of self. The more layered the benefit stack, the more compelling your offer at a time when value is a heightened factor during moments of truth.

Not just any gut health shot. M&S adds B12 to make this product multi-tasking.

Opportunity in the eye of the storm

While economic uncertainty might feel like a threat, it’s also a reset opportunity - a moment when consumers reassess what really matters. And the brands that show up during that process, with emotional intelligence, innovation, and optimism, will earn not just sales, but long-term affinity.

In all my experience, these are the moments to focus your portfolio. Launch joyfully. Don’t be afraid to elevate. And above all, listen to the shifting needs of your consumers. They're most likely NOT downshifting. Rather, they’re probably recalibrating.