From Brand to Product: Why CPG Must Learn From China’s Proof-First Market

Andrew Wardlaw

15 Sep, 2025 | 7 minutes

For decades, global CPG brands could rely on the power of prestige. A Western label signified aspiration, status, and success – most visibly in China, long seen as the world’s ultimate brand showroom. A glossy story, a celebrity endorsement, or a heritage-rich origin was enough to carry preference, loyalty, and price premiums. But that era is over.

Today, Chinese consumers are leading a global shift towards product power:

A new McKinsey survey shows that only 23% of Chinese consumers rank brand name among their top three purchase drivers, while 63% prioritise functionality.

Clearly, a new reality has emerged; one where product performance exceeds brand performance.

This shift is not a niche consumer quirk but a seismic reset. In China’s fragmented, fast-moving digital landscape - where Douyin, Xiaohongshu, and live commerce dominate discovery - consumers don’t want polished campaigns or abstract missions. They want proof. Products must work and must show that they work, in ways that can be reviewed, demoed, or memed.

Proof, it seems, is the new competitive advantage.

The CPG Proof-First Playbook

The most striking examples come from Chinese CPG innovators who have built empires not on mythology, but on products that deliver real, demonstrable value.

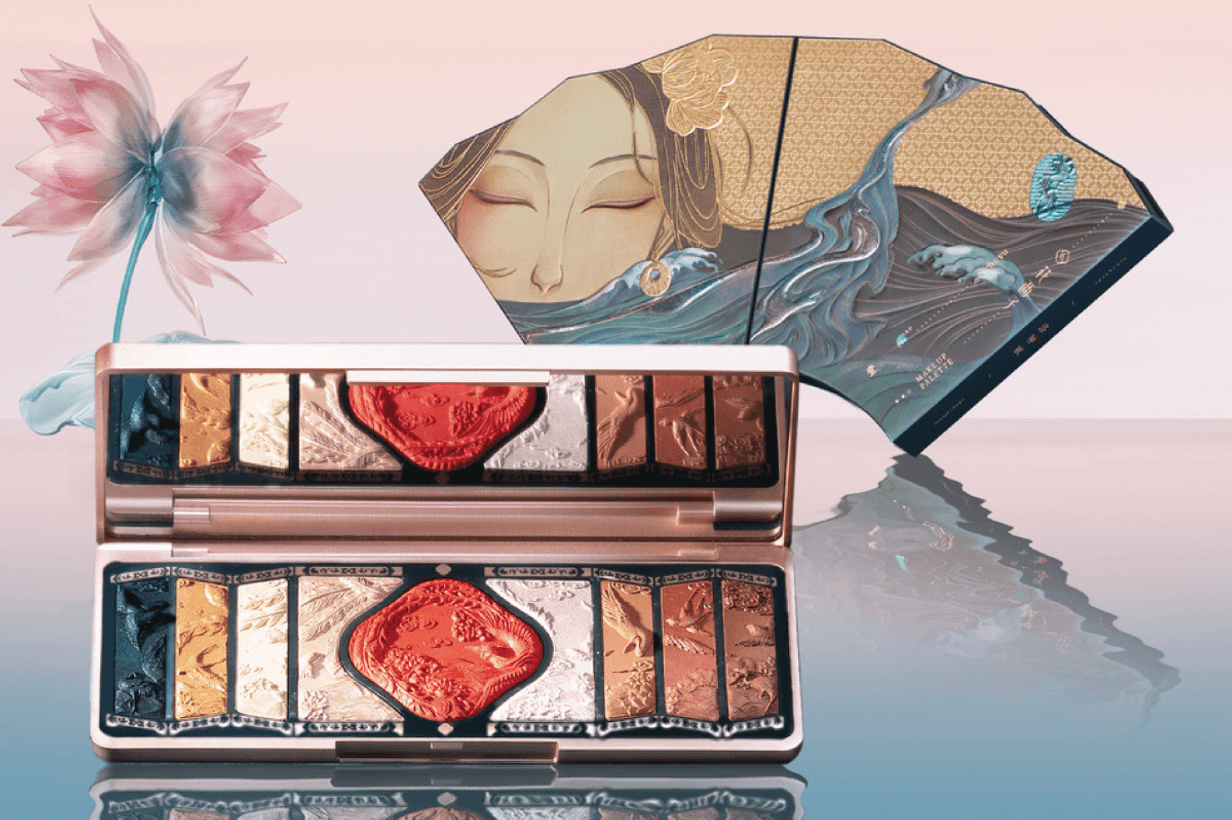

- Florasis (Beauty): Florasis (Hua Xi Zi/花西子) has been in the news for investing heavily in its so-called smart factory in Hangzhou: digitizing the formulation, optimizing quality, and using a ‘smart brain’ to manage raw material sourcing through to packaging. For this brand, product engineering, quality control, ingredient provenance are increasingly central. Its makers recognise that it's not enough to brand a product as ‘natural’ or ‘luxury’ – rather it’s the data, transparency, manufacture process, and visual proof of quality (texture, scent, packaging) that matter most. Significantly, the brand is now expanding into the American market!

- Winona (Skincare): Specialising in sensitive skin, Winona has carved out authority not with glamorous branding, but with focused dermatology-led formulations. The trust it commands stems from consistent results, amplified through word-of-mouth and peer reviews.

- Yatsen’s Perfect Diary (Beauty/Fragrance): Perfect Diary doesn’t rely on heritage. Instead, it builds products for virality: colour drops tailored to Douyin culture, co-branded launches with scientific credibility, and formats designed for influencer trials. Its success lies in social theatre, not brand mystique.

- Luckin Coffee (Beverage): Written off after its accounting scandal, Luckin rebuilt on product innovation. The Moutai Latte became a nationwide sensation not because of the Luckin name, but because the product itself was a social spectacle. Consumers queued for the experience, and the buzz spread feed-first. The chain wants to challenge Starbucks global position and as a marker for this, has just opened its first takeaway shops in New York City.

- IFBH (Beverage): The Thai coconut water brand IFBH recently had a blockbuster IPO in Hong Kong and saw its stock surge - even against a muted consumer spending environment in China. Its appeal is rooted in the product: consumers want healthier hydration, fewer sugars, a refreshing natural beverage, all things IFBH delivers.

Together, these examples prove that success today doesn’t come from a story propping up a product — it comes from a product powerful enough to create the story.

A new wave of Chinese operators are proving that success today doesn’t come from a story propping up a brand, but from products powerful enough to establish the brand.

Beyond CPG: Huawei and BYD Show the Way

This product-first revolution is not limited to beauty and beverages. It cuts across sectors.

- Huawei overtook Apple in China’s premium smartphone market by innovating in chip independence and AI performance , not by telling a global prestige story. The strength of its devices, combined with the ability to demonstrate features in real time, made the brand irresistible.

- BYD, once dismissed as a budget automaker, is now the world’s largest EV seller. Its rise came not from status-driven marketing, but from building affordable EVs packed with cutting-edge features that consumers could experience daily - from fast-charging to advanced in-car tech. For Chinese consumers, BYD’s cars were not just transport, but proof of progress you could sit inside.

These stories matter for CPG. They show that in every category, Chinese consumers are elevating product performance above brand narrative. If Huawei can topple Apple and BYD can overtake Western auto giants, then global food, beverage, and beauty brands should not assume heritage will protect them.

The Multinational Blind Spot

Yet many Western CPG giants remain stuck in brand-first reflexes. Luxury skincare labels lean heavily on Parisian heritage, glamorous packaging, and celebrity ambassadors. But in a proof-first world, those cues are hollow without visible efficacy. Similarly, in categories such as confectionery and sodas, some global brands face erosion from local innovators who can deliver more culturally relevant iterations at speed.

What once was a strength - legacy - has become a problem. As Shanghai-based automotive expert Bill Russo notes: “Legacy becomes your albatross. It’s the weight you carry.” For multinationals, this weight is slowing adaptation, even as local rivals sprint ahead.

The Provocation

What’s happening across China must be a wakeup call for brands around the world. Advertising is still a powerful medium, but it’s not where the momentum is.

For marketers around the world, the message is that if your product cannot act as your strongest piece of brand content, you risk not having a brand.

For CPG leaders, this means a hard reset:

- Design for Proof. Products must visibly deliver. Efficacy, taste, and performance are the new currency of equity.

- Engineer for Shareability. Products must live in the feed as well as on the shelf. If they can’t be demoed, reviewed, or memed, they won’t scale.

- Localise for Function. Stop adapting global formulas; build for Chinese needs, values, and habits from the ground up.

- Let Product Drive Brand. Storytelling no longer sells the product. The product sells the story.

China is the Leading Edge

China is not an outlier. It is the sharp edge of a global transition where consumers everywhere -pragmatic, digital-first, and proof-seeking - are elevating product over brand. The question for multinationals is not whether this model will spread. It’s whether they can unlearn their dependence on narrative and embrace the reality that in the future, the product is the brand.

Want to future-proof your brand? Explore how proof-first strategies can help your brand thrive in this new consumer reality. Get in touch.