Insights

17 Feb, 2026

Five Products: When World’s Collude. The Changing Face of Cleaning

Read More

Andy Wardlaw

11 Jan, 2023 | 5 minutes

Here we go again! But where do we go? Tough times are driving more intentional consumer behavior. To find favor, innovation must demonstrate empathy with people’s shifting need states, whilst making further gains on sustainability – and where appropriate, provide permissible moments of comfort and joy.

Economic pressure and its repercussions dominate this year’s trends reporting. Kantar’s global issues barometer suggests that economic worries now engulf more than half the population – up from 39% in May 2022.

As shoppers put more thought into how they spend their money, private label has an obvious advantage. To improve growth prospects, brands go past reformulating to counter hikes in cost of raw materials and create new or repointed products in opportunity spaces created by the shift in people’s priorities.

Here are 10 opportunity spaces that could spark additional revenue streams in 2023:

95% of marketing professionals indicate that economic recession is already impacting brand planning – according to WARC. Retailers have lost no time in showing that they’re on the side of the people. In the U.K, Boots recently introduced a comprehensive range of ‘everyday’ personal care essentials, for example. Without similar proactivity from brands, there is real risk that many leading products will be ‘deselected’ by shoppers.

Product claims can provide quick wins for brands. P&G recently activated new expressions of value on pack, informing shoppers that its Fairy Liquid formula is now ‘brilliant’ in cold water, saving energy.

A key focus for innovation and renovation in 2023 will need to be value recalibration: updating brand knowledge about what consumers need from your product and revising the whole proposition to deliver. What elements of your brand, pack and product deliver most value for your customers? How can you elevate perceived value across the total user experience? Where can you make cost savings with little or no effect on perceived value or sensory delivery?

Manufacturers must also consider how they step up the fight against the rise of ‘everyday essentials’ ranges in what is proving to be a prolonged period of turbulence. What could this look like for players such as Kellogg’s, Danone and Tyson Foods?

Gallup’s Global Emotions Survey confirms that daily incidence of anxiety continues to rise for the population at large.

In response, there is increasing commercial interest in the mood management space. From invigorating spirits like Three Spirit’s Livener to MAC Pick-Me-Up Eyeshadow. Recently Kellogg’s CMO for Southeast Asia Sanjib Bose said that the company was actively looking at snack opportunities for ‘mood and mind.’ This could be achieved with functionality, but an increasingly popular approach is to activate nostalgia to spark joy - as Pepsi has done with its S’mores Collection (below).

A wistful yearning for a return to a real or imagined past peaked during the pandemic as consumers sought comfort and escapism amid fear, loss, and boredom. Now, with the war in Ukraine and a spiraling cost of living piling on stress, the desire to indulge in nostalgic eats remains

WGSN. ‘The New Nostalgia’

From Neapolitan Ice Cream to Battenburg cake, there is huge scope to develop new comfort foods with nostalgic associations in 2023.

Meanwhile, in beauty, we heard at the In-Cosmetics event in Bangkok in November, that ingredients that can bridge the gap between skin and mind are just around the corner. The Nue Co. is already pushing hard in this space with fragrances that stimulate neural pathways to achieve a shift in mood.

And what if categories such as household cleaning entered the mood management space? This is something we explored in MMR’s End of Year Show, with live consumer feedback confirming interest.

Sustainability is rarely a key driver of purchase, but its importance is on the rise. One study in America surveying beauty consumers reported that 64% shoppers consider sustainability as ‘a very important consideration’ when buying a product – up from 58% in 2019.

P&G is one of many big players forging ahead - launching conditioning bars and solid shampoo in Europe, a move that will push the agenda for mass market innovation. To avoid accusations of greenwashing, transparency will remain important, with brands well advised to provide clear parameters for success to keep consumers on-side.

As brands look to accelerate people’s interest in more sustainable products, what can be done to make eco-friendly products more appealing – and not just less harmful?

With more people continuing to eat at home amid rising living costs, brands and innovators are helping consumers fight meal fatigue with forward thinking frozen food. Value-added products and heat-and-eat solutions that help streamline meal preparation times whilst talking up health benefits will gain traction in 2023.

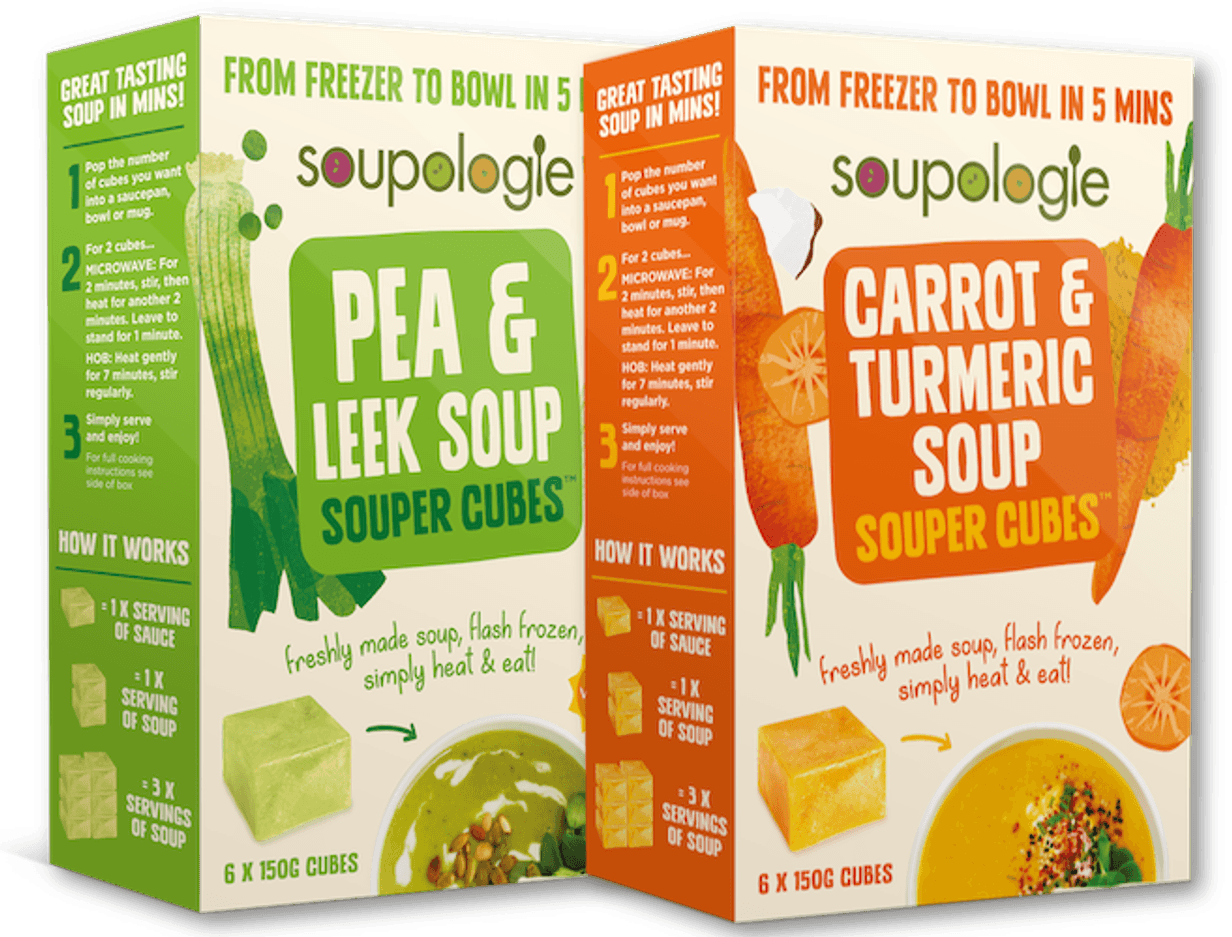

Soupologie is showing the way with ‘the world’s first eco-soup’. The manufacturer has flash frozen its soup recipes, sealing in all the natural goodness. No plastics here – just a cardboard outer and home-compostable inner bag.

As more people discover that frozen food is just as good or better than fresh (currently around half of all Americans in one recent survey), there are opportunities for more manufacturers to enter the freezer cabinet – directly or with joint ventures. It’s worth noting that preference for frozen is pronounced in younger consumers, who have grown up experiencing better options and less stigma around the format.

With homeworking now firmly established for millions of workers, entrepreneurs have identified an opportunity to counter daytime meal fatigue and offer upgrades to typical lunchtime options.

TYME is a fledgling home-delivery company offering nutrient-rich plant-based meals with ‘zero-prep time.’ Its pouch meals have been created by chefs and nutritionists using a science-based approach, then tried and tested to ensure optimal health benefits.

For this innovation hotspot, brands must pay greater attention to Gen Z’s preferences, whose tastes and concerns are poised to transform lunchtime need states. Raised in a globalised, hyper-connected world, Gen Z is more experimental and health curious.

Brands such as BOL in U.K have acted quickly to offer convenient lunch time street food, and the category could go much further as people seek new inspiration to invigorate their day.

Given that many of us are less likely to nip out for lunch, when we do we’re more likely to want to treat ourselves – providing new opportunities for more premium food service options.

As people dine out less, demand for more affordable at-home gourmet offerings is on the rise. Despite a round of price increases to add to its already high premium, U.K ready-meal brand Charlie Bigham’s has seen volume sales soar 8.5% in 2022. CEO Patrick Cairns told ‘The Grocer’ that the brand aims ‘to provide a real alternative to eating out’ or simply provide keen cooks a night off. Even as a proudly premium brand, Bigham’s has a part to play during the current cost of living crisis. Cairns adds that ‘while it is a challenging environment, we believe our proposition is as relevant as ever.’

Meanwhile, thefoodpeople are reporting that ‘Perfect Patisserie’ and ‘Gourmet Sandwiches’ are trending as people seek out everyday items with added luxury as a coping mechanism.

To enter this space, innovators must turn to specialty ingredients that deliver restaurant-at-home moments. Attention will need to be paid to the full user experience. From in-store presentation to the complete flavor journey.

With concerns about the rising price of grocery shopping, vehicle fuel, and energy bills - people are acting more intentionally to minimise expenditure - and this is extending to how meals are prepared.

The energy efficiency and versatility of air fryers, which cook via rapid air circulation, mean they have surged in popularity across 2022. By November, Leatherhead Food Research reported that 30% of U.K households now own one – and as many as 51% households with 3 or more children. Moreover, a further 22% of U.K households were planning on buying one in 2023. Estimates for the U.S put air fryer penetration at well over 40%.

With so many of these appliances in circulation, big name brands are starting to call out air fryer capability, and in 2023 it will be time for manufacturers to develop meal solutions that are ‘ideal for’ air fryers. Culinary innovators are creating recipes from Korean fried chicken to Basque burnt cheesecake to demonstrate their adaptability across social media.

At the Future of Food Summit in Chicago in 2022 it was claimed that the next ten years will make the last fifty look like we were all going at a snail’s pace. With animal-free dairy now a reality in the U.S.A, and the country’s Food & Drug Administration providing the go-ahead for the production of cultured meat – the snail just got its rocket boosters.

But there’s a massive issue. Consumer behavior is typically slow to adapt. As a marker, the Friedman School of Nutrition Science and Policy recently found that people’s diets across 185 countries have barely shifted at all over the last 30 years – despite considerable effort to encourage us all to eat more healthily.

In 2023, this opportunity space must work on its dictionary as much as its product delivery. Terms like ‘animal-free dairy’ are proving highly confusing to mainstream audiences and cultured (or cultivated) meat doesn’t fare much better. There’s a clear and present danger that efforts to reduce the impact of consumption on the environment could follow the same path as plant-based meat alternatives, which have already lost momentum (and sales) as consumers revert back to what they’ve always done.

So, whether you’re planning on animal-free dairy cream cheese or skin rewilding cleanser, it is crazily important that you develop and test a range of positive naming conventions and avoid red flag associations such as free-from, alternative and lab-grown – all made clear by new research by MMR.

Scientists report that the digital age is driving people towards heightened experiences in real life (IRL) –prompting everyday goods and services to up their game. In the midst of economic tightening, consumer-packaged goods are relatively well placed to offer moments of joy. In 2022, brand owners switched on ‘Mystery Flavors’ to deliver awe and wonder. In 2023, there is an opportunity to move this on and into the realms of sensory discovery.

WGSN reports that the role of the discovery box is advancing, most notably in fragrances. Discovery boxes offer consumers immersive and enriching experiences. Currently offerings center around wellness, self-expression and sensory exploration.

Brands cannot ignore the long-term disruption in shopper attitudes that is expected from the cost of living crisis, but alongside value propositions, discovery products can be affordable as well as aspirational. Faced with the prospect of a well-crafted sensory experience, democratizing discovery could be a fruitful way for brands to incentivize cash-strapped consumers to justify spending. In perfumery, Commodity discovery sets allow customers to explore personal, expressive and bold fragrances at reasonable prices. The question is, what would discovery look like in your category?

With over half of U.K and U.S households buying groceries online, retailers will be looking to manufacturers to help them create a more impulsive dynamic in store – particularly in the U.K where impulsive items such as chocolate and salty snacks are no longer allowed in prime locations.

Aside from bargain hunting, there is evidence that shoppers are increasingly using store environments for new product discovery, so working with retailers to increase visibility of new products IRL could find favor.

As well as offering shoppers the chance to discover, physical retail has the propensity to offer more personalized experiences. For high end inspiration, look no further than Bulgari, the luxury Italian fashion and beauty brand. It has redesigned its presence in Parisian department store Samaritaine, to ensure a more personal service. Shoppers can create their own personalized fragrance by adding their choice of Bulgari's Magnifying Essence to its Allegra fragrances (as seen on MMR’s Power of Aroma webcast), with advisors on hand to guide them - as well as a dedicated app.

Meanwhile, back in the supermarket, orient brand teams around occasion based cross-merchandising opportunities, innovative flavor pairings and creative packaging ideas that make your offer jump from the shelves.

The thing about recessions, they prompt people to question their choices when ordinarily they would not bother. In the low attention economy, brands can no longer rely on media investment to show that they care – they must instead demonstrate empathy with revised and updated product ranges.

Contact us at MMR to discuss how we could work together to support your growth objectives in 2023 and beyond.