Insights

17 Feb, 2026

Five Products: When World’s Collude. The Changing Face of Cleaning

Read More

Andy Wardlaw, Chief Ideas Officer

12 Apr, 2019 | 5 minute read

“Nowhere is too far to travel for good food”. The most premium Amazon brand, with a range of Italian foods including pasta, pesto, oil and vinegar.

At the cheaper end of the scale, a range of low-cost products including tea, coffee, seasonings, biscuits, condiments and razor blades.

“Happiness in every handful”. Nuts, seeds, dried fruits and coffee

“Cleanliness & hygiene at your command”. Toilet tissue, kitchen rolls, laundry detergents, washing up liquid, dish-washing tablets…

“A high-energy fitness brand dedicated to your fitness goals". A limited range of protein bars and powders.

Using our MMR Express platform, we used a combination of AI, direct questioning and pricing techniques to pressure test the Amazon ranges vs. established brands.

At a superficial level, we found broad consensus that Amazon has the credibility to succeed in grocery. Most people talk positively about Amazon’s delivery capability (80%), trustworthiness (77%), ease of use (74%) and price (70%). But we also detected significant levels of confusion in respect of how grocery deliveries would be made. “Dirty white vans?” thought many! There was further negativity around freshness and company ethics.

For the ranges themselves, Amazon’s landing is a little bumpy. For each of the five Amazon brands we profiled, many fail to solicit decent levels of trust, confidence or sophistication.

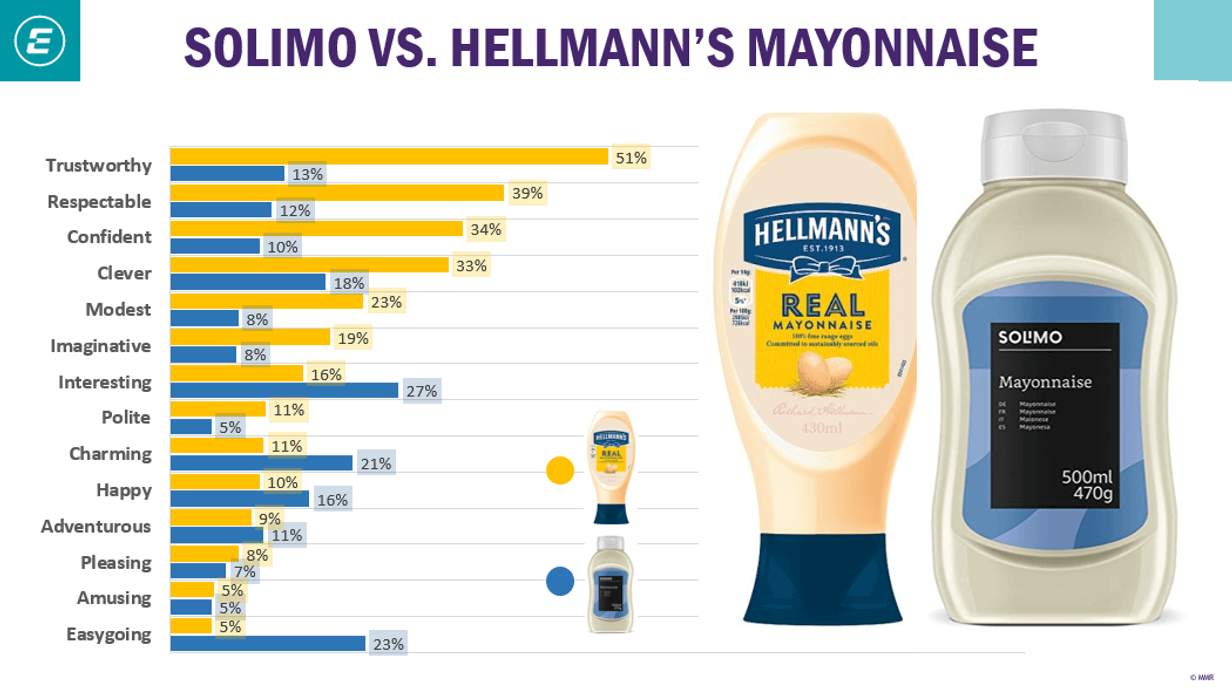

In the battle between Mayonnaise contenders, our AI approach (which captures consumer sentiment without asking questions) detected 90% of participants discussing taste when confronted with Hellmann’s, with only 64% doing so with Solimo. Hellmann’s also stirred up a lot more discussion around quality and pack aesthetics.

A similar story plays out in the battle between Fairy Liquid and Amazon’s Presto brand. Fairy lords it over Presto, which fails to make any meaningful impression at all. Basically, it’s all a bit ‘meh’.

But I hear you say ‘people will vote with their wallets!’ Not necessarily so. Amazon’s pricing strategy is not about being the cheapest around. It knows that customers – be they individuals or small businesses – value the convenience of next day delivery and no minimum order size. Despite consistently lower prices, Amazon are unable to make serious in-roads in our study.

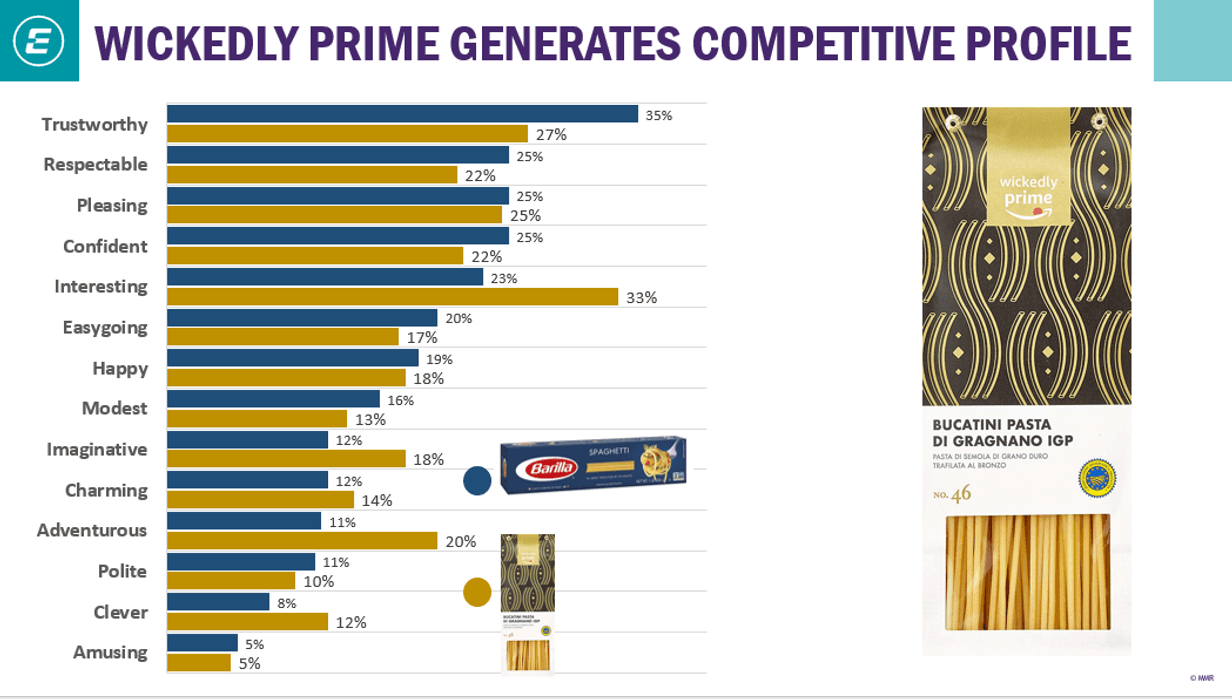

There is more encouraging news for the online giant with its Wickedly Prime Spaghetti. We pitched it against Barilla and as the illustration reveals, it does a pretty good job at creating positive emotions.

The algorithm found both brands equally successful at generating conversations around Italian heritage (86%), with the Amazon offer generating higher engagement around taste (79% vs. 70%) and health (78% vs. 57%). When it comes to creating a brand, conceptually at least, Wickedly Prime Spaghetti has delivered something that fires people’s imaginations. Not something that we can report for Presto or Solimo.

To understand the tangible reality of Amazon’s offer, we headed into the homes of some highly articulate shoppers with great levels of sensory acuity. We pitched their usual brand against an Amazon ‘equivalent’ with a mission to take things beyond liking – probing to see if Amazon brands are doing enough to be adopted by the nation.

Discerning Alex: Hellmann’s Mayonnaise vs. Solimo Mayonnaise

Alex is a Hellman’s aficionado. He loves its smooth and creamy texture. “It’s just so rich… and white” he tells us, licking his finger. When we offer him the Solimo product, expectations are immediately influenced by its colour. “It’s yellow. More like a salad cream.” Making his usual tuna & mayo sandwich he notes its runny texture. “That tells me it’s cheaper”. When trying the completed sandwiches, the Hellmann’s one rates highly, just as he expected. For Solimo sandwich, it’s bad news. “It’s sharper. Not as creamy I’d say. More artificial.” His final verdict on Solimo: ‘It’s a chip shop mayonnaise’ – and not in a good way.

BRANDS 1 - AMAZON 0

Responsible Deborah: Nespresso Coffee Pods vs. Happy Belly Coffee Pods

Deborah loves Nespresso. In fact, the pods have become a feature item on her kitchen counter. She loves the range of coffees on offer and via an App, the seamless ordering and recycling service. The pods are described as ‘beautiful’ and ‘tactile’. The coffee touches her senses – the uplifting aroma, the creamy layer, the intense taste. After this Happy Belly needs to work hard. She discovers that the pods are individually wrapped in plastic film. “It’s wasteful”. She detects coffee aroma from the pod that emerges, indicating that flavor has not been locked in. So, none of us faint with amazement when the drink itself fails to shine - starting without an aroma and ending with a watery flavor. “I don’t think it’s got a lot of flavor. I’m quite disappointed.”

BRANDS 2 - AMAZON 0

Meticulous Karen: Fairy Liquid vs. Presto Washing-up Liquid

Karen always goes back to Fairy. It’s a brand she really trusts. “The quality, the suds really last and it’s a good price. You know that something’s working on your dishes.” Efficacy that Karen really feels. Presto immediately falters in the sniff test (“and I’ve smelled a lot of washing up liquids in my time”). “It doesn’t smell right… too sweet… I can’t imagine it washing my dishes.” Showing her sensory acuity, she adds “it doesn’t smell thick… luxurious.” A ‘prime’ example of how the human senses cross over when evaluating products. The real test started in the sink, where an obvious lack of suds (despite a generous dosage) causes much alarm! “It looks like the end of the wash” she observes, “not the start of it.”

BRANDS 3 - AMAZON 0

Competitive Mike: Grenade Protein Bars vs. AMFIT Protein Bars

Mike is a Grenade man. He goes for its “loud and powerful packaging” that clearly informs on how much protein he is about to gobble. The same is not true for AMFIT, where Mike really struggled to find the information he needed. So, whilst the product does a reasonable job, Mike believes he never would have got past the packaging problem.

BRANDS 4 - AMAZON 0

Adventurous Malcolm: Barilla Spaghetti No.5 vs. Wickedly Prime Spaghetti

And so began the final battle. Barilla starts well for Malcolm. “It looks nice and golden… like it’s been grown in the sunshine.” The power of appearance is made evident. So, after a series of defeats, we were keen to see if Amazon could pull it out of the bag. We were encouraged when the Amazon spaghetti also started well. “It looks like a quality product” is Malcolm’s initial assessment. Taking the spaghetti out of the thick cut bag, we are then surprised to discover that it is ‘U’ shaped, “like it has been hung out to dry”. A great sensory cue for batch production if ever there was one. Twinned with a Wickedly Prime Pesto, the final result truly inspires Malcolm. “Given the Italian text, the feel of the pack, the way it looks… I’d be convinced that this was an authentic Italian experience on a plate”.

BRANDS 4 - AMAZON 1

This has been a fun and engaging piece of research for us at MMR, and in our opinion raises some serious questions for Amazon if they wish to go on and develop these ranges. The general failing of Amazon's packaging to reassure and engage, and the absence of well-chosen sensory cues to deliver against expectations is startlingly evident. We know that Amazon are in the experimentation stage here, and that Wickedly Prime Spaghetti does illustrate that they can get it right if they really put their minds to it. So, we will wait with interest to see what Amazon does next.

For further information, please get in touch with us at MMR, including free access to all the research.

If you'd like to understand a bit more about us or find out how we can help solve your challenges, check out our team's availability and book in a call at a time that suits you.

If you'd prefer to chat over email, fill out your details below and we'll get back to you as soon as we can.