Insights

25 Feb, 2026

Using AI to fuel creativity: How Agentic AI Is Unlocking Bolder Ideas

Read More

Andrew Wardlaw

01 Feb, 2023 | 3 minutes

As another ‘Veganuary’ fades from view, all eyes will be on this year’s sales figures. Recent performances from plant-based meat brands have been shaky. And new research from MMR Research Worldwide, spanning key markets including U.K, U.S, South Africa, Netherlands, China, and Singapore has found that comparatively high prices (versus meat), questionable health credentials (long ingredient lists) and below par sensory performance are formidable barriers to category engagement.

But there’s more. Immersive conversations with eco-progressive consumers have revealed a new growth inhibitor to be reckoned with – a plant-based paradox that predicts that the closer plant-based manufacturers get to mimicking meat, the more suspicious people will become about product integrity. It’s a paradox that could undermine expected gains in product quality.

If we’re really serious about turbo-charging this category (currently estimated to be worth 1.4% of global meat sales), then maybe it’s time to do something different. To continue on the current course is unlikely to make a significant dent in the 60% or so of western consumers who describe themselves as omnivores. At worst, changing nothing could mean that the plant-based category as we know it eventually goes down in history as one big curiosity trip.

This is not to suggest that a lot hasn’t been achieved! It has delivered retail sales of $5.1bn in 2021, up 17% according to Euromonitor. It’s attracted the attention and creativity of premier league players including Nestle, Unilever and Tyson Foods. Products containing mycoprotein have been found to offer formidable nutrition. However, we must face facts, that in recent months, refrigerated meat alternatives have experienced double-digit sales declines in key markets such as the U.S and U.K. Global forecasts that the category could be worth $16bn by 2027 are starting to look ambitious.

A market shake-out is already under way. As Conagra puts it: ‘if you have slow-turning products in a place that’s fairly perishable, that’s a high risk, and there’s no way the space supports 20 manufacturers making burger patties.’ Brands such as British-based Taste and Glory have been withdrawn. The McDonald’s McPlant Burger looks like it has a limited future after sales fell well short of target in trials. And in September, Deloitte reported that ‘the addressable market maybe more limited than we thought.’

With hindsight, this outcome was foreseeable. The plant-based fixture has attracted so many players that the casual consumer is unable to confidently select one brand over another. Many products are not considered to be ‘clean label’ – which matters because the number one reason people give for category engagement is actually ‘to feel healthier.’

And then there’s that behavioral bombshell that I revealed earlier. It means that further improvements to product performance that bring the experience even closer to meat might not be the way to woo all shoppers. Our research, together with interventions from behavioral science, suggest that narrowing the sensory gap with animal protein actually creates uncertainty for many.

I've seen eco-progressive individuals transition from a happy state of awe and wonder (e.g., ‘how do they do that?’) to a less happy state of confusion and concern (e.g., ‘but how can this be safe?’). A parallel survey by MMR attaches some numbers to this situation - with 41% of Americans agreeing with sentiment that plant-based meat alternatives are some form of ‘weird science.’

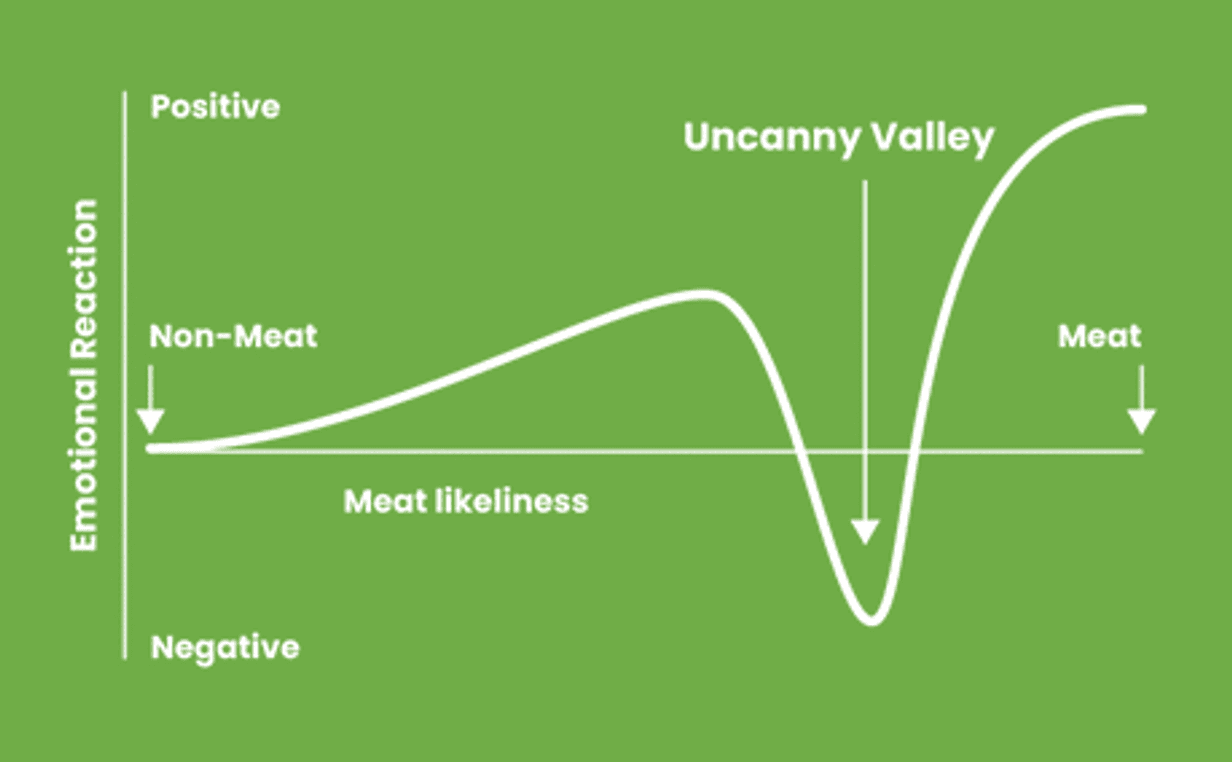

Dr Mark Haselgrove, Associate Professor of Psychology at the University of Nottingham, and Behavioral Science Consultant with The Together Agency offers insight into why this paradox occurs. ‘There is an explanation known as the uncanny valley. You can see it playing out with people’s responses to human-like robots (as illustrated in the picture below). As the resemblance to human increases people experience an increasingly positive emotional reaction – until just before the tech masters a life-like quality, and there is a dramatic dip towards the negative.’

‘For plant-based, as the offer has become more meat like, people have been generally impressed. But as the industry continues to narrow the sensory gap with real meat, we can expect the consequences of the uncanny valley to kick in. The uncanny valley brings uncertainty!’

And experience tells us that as soon as people become uncertain, they begin to question everything.

It’s a paradox that could push the category into a prolonged dip. If manufacturers close the sensory gap entirely, category performance could find itself in the valley. But if manufacturers fail to close the sensory gap, they will fail to convert those mainstream meat lovers.

Nicole Johnson-Hoffman of Future Meat Technologies is not wrong when she told Food Navigator that we cannot expect mainstream shoppers to compromise their way out of climate catastrophe.

Louise Hitchen, Head of Digital Qual at MMR, believes that the ‘hand-holding strategy’ of mimicking meat may have run its course. ‘Let’s be clear, plant-based burgers and sausages can be easily price checked against other meat versions – and it’s not good news at the moment.’

A case in point is a recent in-store test at Asda, the U.K retailer, which placed plant-based meat alternatives next to their animal counterparts in an attempt to boost sales. The trial actually produced the reverse effect. Sales fell 30%, with ‘transparency of the price gap with meat’ blamed for the result.

In light of current events, fresh consumer research and the teachings of behavioral science, it is time for a new phase in the evolution of plant-based meat alternatives – towards a more distinctive plant-based proposition, tapping into appealing health narratives such as nutrition density and diversity.

How can it be that the plant-based category has ended up looking so beige? Whatever happened to the rainbow of colors provided by mother nature?

With cultured meat now imminent, and better able to match the nutritional and sensory profile of farm-reared meat, the opportunity for plant-based is to expand into new, more distinctive product areas that create a more diverse and interesting category. A new theater of sensory discovery.

In 2023, we must consider a new vision for plant-based, making it the most colorful category in store.

Catch me that this years Plant-Based Conference on the 8th of Feb.